Exclusive: Powai Lake Ventures goes slow on new startup bets

Powai Lake Ventures, a network of Mumbai-based angel investors who backed startups mostly in the city, has slowed dealmaking this year as some of its bets misfired and the overall funding environment turned cautious, two people aware of the development said.

The angel network had ramped up the pace of investments in 2015, buoyed by previous successful bets on cab aggregator Ola, real estate portal Housing.com and ed-tech startup Toppr. It invested in eight startups last year but some of those investments turned duds.

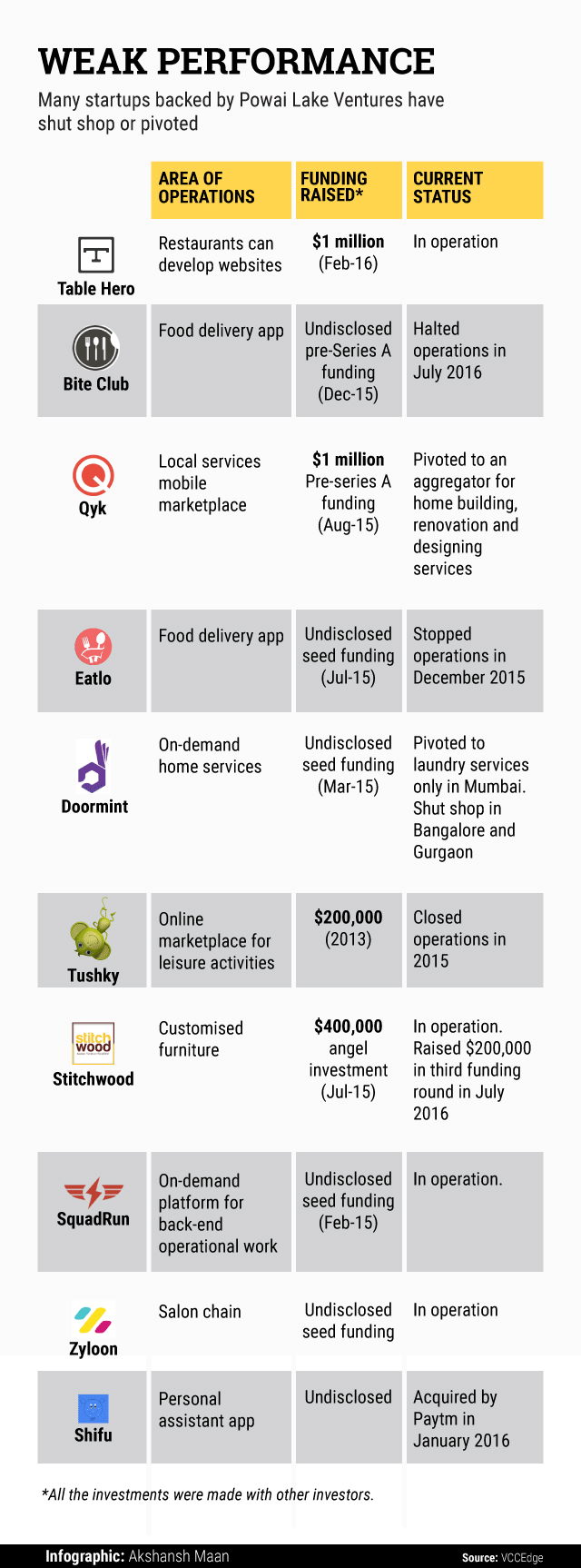

In 2016, it has invested in only one startup--TableHero, a Bengaluru-based company that enables restaurants to develop websites. Overall, its portfolio includes startups such as Shopsense, Chaayos, SquadRun, Tushky, Qyk, Stitchwood, Eatlo and Bite Club.

According to one of the people cited above, Powai Lake's style of closing deals quickly has backfired. "They used to pride themselves on how fast they made their investments. This was their strong point once upon a time. Eventually, this came to bite them," this person said, asking not to be named.

The person said that a lot of the network's deals failed because due diligence was not done properly. "What was initially attractive about them, started looking like their biggest mistake. As a result, they stopped doing deals," the person said.

The Powai Lake Ventures angel network comprises Toppr co-founder Zishaan Hayath, Abhishek Jain, Shishir Kapoor, Vaibhav Puranik, Saurabh Saxena and Gagan Goyal.

Hayath, co-founder of Powai Lake, didn't respond to an email query but separately said the network made three investments in 2015-16–in personal assistant app Shifu, TableHero and salon chain Zyloon.

Shifu was acquired by Paytm in January 2016 for a reported $8 million (Rs 53 crore). Among its other bets, food delivery startup Eatlo closed in December 2015, travel-tech venture Tushky stopped operations last year and mobile-based laundry service provider Doormint also scaled down its operations.

Local services marketplace Qyk pivoted its business model in May while food delivery marketplace Bite Club halted operations last month.

To be sure, Powai Lake Ventures isn't the only investor group to go slow. This is true also for some other angel networks as well as venture capital and private equity firms, as last year's euphoria gives way to more practical decision making. And it's not just Powai Lake-backed startups that are facing tough times. Many other startups, too, have shut or scaled down operations, cut jobs and pivoted their business models in search for profitability.

Another angel network that has slowed the pace of investments this year is Mumbai Angels, from 18 deals last year to only three so far this year, according to VCCEdge, the data research platform of VCCircle. But the Indian Angel Network is showing no signs of slowing; it has made 23 investments so far this year compared with 25 in the entire last year.

Overall, angel and seed-stage deals fell to their lowest in five quarters in the April-June period. Venture capital and private equity deals have also declined this year, both in value and volume terms.

Like this report? Sign up for our daily newsletter to get our top reports.