Overall Indian mobile handsets shipments in CY 2014 touch 257M units, Samsung still leads the pack: CMR

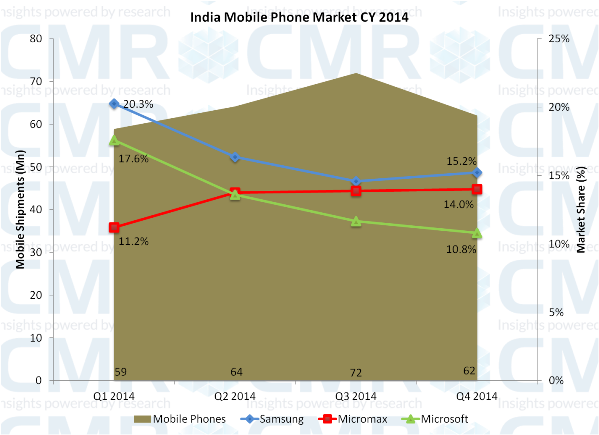

India's overall mobile handsets shipments in the calendar year (CY) 2014 stood at 257 million units, recording a year on year growth of 4 per cent over CY 2013. The third quarter of 2014 proved to be the peak quarter in terms of sales, accounting for 28 per cent of all mobile phones sold in the year, according to a report released by CyberMedia Research (CMR).

Samsung emerged as the overall leader in the market during CY 2014, with a 16.5 per cent share of shipments, followed by Micromax and Microsoft (Nokia) at 13.3 per cent market share. However, Samsung somewhat lost its firm grip on the market, as its market share showed a downward trend during the year. In comparison, home grown handset and tablet manufacturer Micromax's market share gained primarily in Q2, 2014, but then continued to remain flat during the rest of the year. It was also the only player among the top three to improve its market share.

Strong smartphone growth

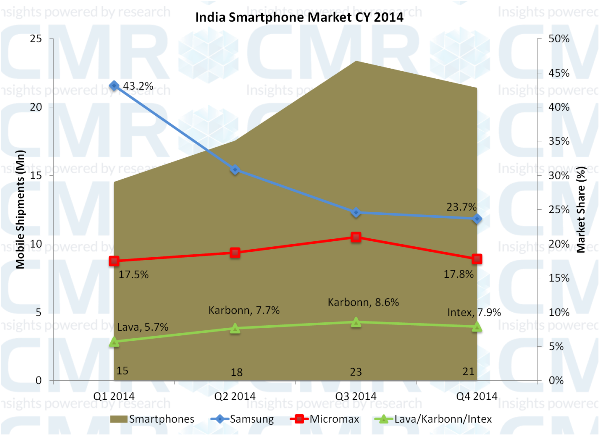

With 77 million smartphones shipped in CY 2014, the segment accounted for nearly 30 per cent of all shipments, a first for India. The smartphones segment in itself grew at 46 per cent over CY 2013. The strong growth of smartphones was propelled by a number of reasons, including availability of a wide range of models and brands under Rs 15,000; pickup in online sales; increasing mobile data consumption; and decline in data tariffs plus operators extending their data network footprints. A number of new brands also emerged in the India market during the course of the year.

With 77 million smartphones shipped in CY 2014, the segment accounted for nearly 30 per cent of all shipments, a first for India. The smartphones segment in itself grew at 46 per cent over CY 2013. The strong growth of smartphones was propelled by a number of reasons, including availability of a wide range of models and brands under Rs 15,000; pickup in online sales; increasing mobile data consumption; and decline in data tariffs plus operators extending their data network footprints. A number of new brands also emerged in the India market during the course of the year.

"2014 proved to be a path-breaking year for the India mobile phones market, essentially in terms of the high proportion of smartphones shipped. A lot of consumer enthusiasm was seen in terms of launch of new phone models and brands, unique features and a significant change in sales strategies of vendors. This resulted not only in making available a wider set of options for buyers, but also challenged industry players to remain competitive as well as creative in their offerings," said Faisal Kawoosa, lead analyst, Telecoms Research at CMR.

Note that CMR uses the term 'shipments' to describe the number of handsets leaving the factory premises for OEM sales or stocking by distributors and retailers. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CMR does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or 'grey market' handsets.

Top smartphone vendors

Samsung maintained its leadership in the Indian tablet market, however, the company saw a considerable fall in its market share, primarily at the hands of Apple gaining in the premium segment, and a number of Chinese brands/original equipment manufacturers (OEMs) hitting the mid-range smartphones segment.

Micromax was able to retain its number two position in the smartphone segment throughout the year despite stiff competition at the hands of Chinese brands/OEMs as well as a few Indian brands. Interestingly, the third spot in the smartphones segment was not held firmly by any single brand, with Lava, Karbonn, and Intex vying for this position throughout the year.

"With smartphone penetration reaching new highs, leading brands competed with each other to provide the highest levels of selling experience. Going forward, the challenge would to provide customers equally high levels of after-sales experience across the length and breadth of the country," said Karn Chauhan, Telecoms Analyst at CMR.

"Some of the new smartphone brands rely exclusively on online sales and it would be interesting to watch how they go about increasing their market footprint, to penetrate deeper into upcountry locations. Such expansion would help them reach a large base of potential buyers without easy access to online platforms," concluded Chauhan.