Overall Indian tablet shipments in Q2, 2013 touch 1.15M units; Samsung still leads the pack: CMR

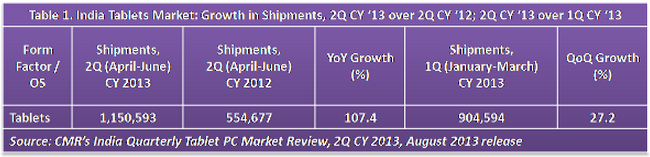

India's overall tablet shipments in the second quarter of 2013 (April-June 2013) crossed the 1.15 million units mark, recording a year on year growth of 107.4 per cent, and a more moderate increase of 27.2 per cent quarter on quarter, according to a report released by CyberMedia Research (CMR).

While the shipments were done by as many as 70 domestic and international vendors, only 13 vendors shipped in significant volumes of more than 20,000 units during the period. The top five vendors accounted for nearly 56 per cent of the total tablet shipments and six local vendors figure in top 10 brands list during the quarter.

Note that CMR uses the term 'shipments' to describe the number of tablets leaving the factory premises for original equipment manufacturers (OEM) sales or stocking by distributors and retailers. In the case of tablets imported into the country, it represents the number leaving the first warehouse to OEMs, distributors and retailers. Also, CMR does not track the number of tablets brought on their person by individual passengers landing on India soil from overseas destinations, as well as tablets for distribution by the Government of India or state governments (as part of their social welfare schemes, scholarship programmes, etc.).

"For a few quarters now, we have seen over a million shipments per quarter of tablets with only Q1 2013 being the exception. The second quarter results have again shown that one million units a quarter is a sustainable number, which is a healthy indicator about adoption of the tablet form factor in the country," said Faisal Kawoosa, lead analyst, CMR Telecoms Practice.

Samsung still No.1

Samsung maintained its leadership position with a 15.3 per cent market share. Interestingly, the controversy-driven Datawind came it at second position, with a 12.3 per cent market share. Note that Datawind shipments excluded the shipments of Aakash tablets, since those were a part of Government of India's low-cost tablet distribution scheme to students. Homegrown manufacturer Micromax completed the top 3, with 11.7 per cent market share.

Dual-SIM & 3G enabled tablets lead the way

Interestingly, almost 80 per cent of the tablet models launched during this period were with both 3G and Wi-Fi connectivity, leading to a growth of 103 per cent in the shipments of 3G tablets. An important factor for increase in 3G-enabled tablet shipments was the growing data consumption amongst telecom subscribers to access social media networks and IM accounts, play online games, or simply browse the web for information on the go. Also, this was the first quarter when tablets with dual-SIM functionality arrived in the Indian market.

"With the requirement for mandatory adherence to Bureau Of Indian Standards (BIS) certification, it will be interesting to see if there are any significant shifts in tablet shipments in the forthcoming quarters, since it will be difficult for vendors who do not get their products BIS-approved to sell in India. This may lead to some consolidation in the India Tablets market in the short- to medium-term," said Tarun Pathak, analyst, CMR Telecoms Practice.